Series ee bonds worth

Series EE bonds earn interest at a fixed rate whereas I bonds use a composite rate comprising a fixed interest rate and a variable inflation rate. The interest for those older bonds is calculated.

How Series Ee Savings Bonds Are Taxed Efpr Group

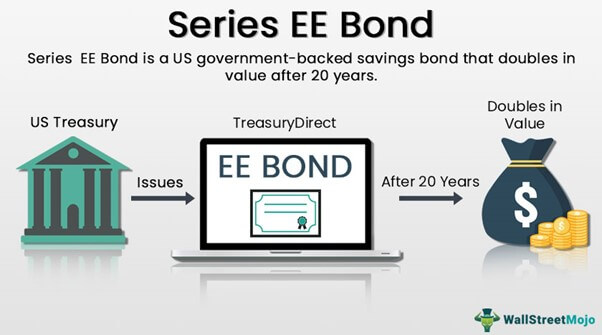

Series EE bonds are a type of low-risk US.

. Learn about Series EE savings bonds issued by the US. Regardless of the rate at 20 years the bond will be worth twice what you pay for it. The bonds were purchased at half their face value.

Heres what you need to know. Must contain at least 4 different symbols. Regardless of the rate at 20 years the bond will be worth twice what you pay for it.

The Balance Menu Go. A REVIEW OF SERIES I BONDS The government issues series I bonds in the same denominations as series EE bonds50 75 100 200 500 1000 5000 and 10000. All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue.

If you paid 2500 for it it would be worth 5000 in January of 1993. Investors can buy up to 10000 worth of I bonds annually through the. Clients may buy a maximum of 60000 worth of I bonds each year.

Series EE bonds purchased since June 2003 mature 20 years after the date of issue. Federal government suspended issuing 30-year Treasury bonds for four years from February 18 2002 to February 9 2006. EE bonds issued since May 2005 earn a fixed rate of interest.

Unlike EE bonds however I bonds are issued at face value. Series EE Bonds Issued May 2005 and Later Series EE bonds issued from May 2022 through October 2022 earn todays announced rate of 010. If you keep the bond that long we make a one-time adjustment then to fulfill this guarantee.

This is just one example of how to calculate the value of a paper savings bond. In addition to their face value or par value EE bonds offer an interest. Save in a reliable low-risk government-backed product.

When you buy the bond you know the rate of interest it will earn. Buying Series EE Savings Bonds. At 20 years a bond we sell now will be worth twice what you pay for it.

6 to 30 characters long. Series EE bonds issued May 2005 and after earn a fixed rate of interest. Series EE Series I.

Series EE Savings Bonds Can Defer Income Taxes Until Redemption or 30 Years. 30000 in paper bonds and 30000 in electronic bonds. You would never actually.

Treasury offers a savings bond calculator that can help you figure out what youve earned and what your bond is worth today. After 20 years the bond reaches a maturity value of 200. Use EE bonds to.

At 20 years the bonds will be worth at least two times their purchase price. ASCII characters only characters found on a standard US keyboard. EE bonds issued from May 1997 through April 2005.

At 20 years the bonds will be worth at least two times their purchase price. Government used budget surpluses to pay down federal debt in the late. Series EE Bonds Issued May 2005 and Later Series EE bonds issued from May 2022 through October 2022 earn todays announced rate of 010.

The Treasury makes a one-time adjustment to fulfill this guarantee. A 50 paper Series EE savings bond issued in April 1992 at a price of 25 was worth 10368 in May 2022. However the EE bonds value will be worth twice the amount you paid for it in 20 years regardless of the interest rate.

This means that a bond with a 5000 face value could end up being worth 20000 or 30000. What is an EE bond. This means that a 25 dollar bond will be worth 50 after 20 yearsequaling an.

All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue. After all Series E savings bonds were replaced by Series EE savings bonds in 1980and they probably arent gathering interest anymore. Say you have a bond worth 100 and an interest rate of 020.

Series EE and Series I. When you buy the bond you know the rate of interest it will earn. Treasury bonds T-bonds also called a long bond have the longest maturity at twenty or thirty years.

The current generation of savings bonds Series EE bonds began in 1980. Series EE savings bonds can be redeemed a year from purchase but you wont see the same level of returns if you cash in your bond before it matures in 20 years. All Series EE bonds expire in 30 years Pendergast says.

They are only available in electronic format. This is a point that most new investors dont. A Patriot Bond is a type of Series EE savings bond that was issued for a period of 10 years following the 911 attack.

The worth of a Patriot Bond is enhanced by tax advantages. They have a coupon payment every six months like T-notes. Scudillo suggests that investors should consider that series EE bonds are guaranteed to double over 20 years and I bonds.

If you keep the bond that long we. Now you may only obtain Series EE bonds by purchasing them electronically at TreasuryDirectgov. Government through the Department of the Treasury.

Now might be the time to. If you keep the bond that long we. The US Treasury produces two types of savings bonds.

What is an EE bond. EE bonds purchased between May 1997 and April 30 2005 earn a variable rate of interest. If you keep the bond that long we make a one-time adjustment then to fulfill this guarantee.

EE bonds issued since May 2005 earn a fixed rate of interest. Buying Series EE Savings Bonds. EE bonds issued in May 2005 and after earn a fixed rate of return.

Regardless of the rate at 20 years the bond will be worth twice what you pay for it. The rate is 010. In the past you purchased paper bonds at half of their face value that is you paid 50 for a 100 bond whereas now electronic bonds are purchase at their face value.

1 2012 financial institutions stopped selling paper bonds. They will continue to earn interest until 30 years from the date of. Series EE bonds sometimes called Patriot Bonds after 2001 differ from Series I because they are guaranteed to double in value after 20 years.

Series EE savings bond in January of 1983 it would have matured 10 years later. The rate is 010. Savings bond that are guaranteed to double in value after 20 years.

Both bonds permit to buy only a maximum of 10000 worth of electronic bonds but I bonds allow to. The redeemed value equals the price plus accrued interest. Series EE bonds issued before June 2003 were purchased at half the face value with the promise that they would double to face value over 20 years.

Series EE Savings Bonds.

Savings Bonds And Your Estate Keystone Elder Law P C

Ee Savings Bonds Begin To Invest

Are Series I Savings Bonds Worth It The Welch Group

How To Check Or Calculate The Value Of Savings Bonds Bankrate

How To Track Down Uncashed Savings Bonds Business Local Buffalonews Com

What To Do With A Savings Bond From Your Childhood Bankrate

Is It A Good Idea To Buy U S Savings Bonds To Pay For School Savings Bonds Treasury Bonds Best Investments

Here Is A New Investor S Guide To Series Ee Savings Bonds Savings Bonds Safe Investments Investing

Series Ee Savings Bonds When To Redeem For The Maximum Return Mybanktracker

When An I Or E Savings Bond Matures Is It Worth More Than The Face Amount

What Are Bonds And Are They Worth Investing In Investing Investing Money Savings Bonds

Should You Redeem Your Savings Bond Use This Calculator To Find Its Value

Us Savings Bonds Closeup Closeup View Of 100 Dollar Us Savings Bonds Affiliate Closeup View Savings Bonds Sav Savings Bonds Us Savings Bonds Bond

Series Ee Savings Bond Us Value Maturity Interest Rate

What Are Ee Bonds How Do They Work Thestreet

How To Check Or Calculate The Value Of Savings Bonds Bankrate

Moneyness The Best Investment In The World